When you inherit a property from your previous generation, it comes with strings attached.

Are you scared of taxation and can’t remember any clauses? We got your back with our inheritance tax coursework help. If taxation is not your dream subject, you’re probably dreading inheritance tax too.

You have been given this coursework for these two major reasons:

With so many clauses and sections to retain, one can use inheritance tax coursework help. Do you know that this used to be one of the largest revenue sources of the UK government?

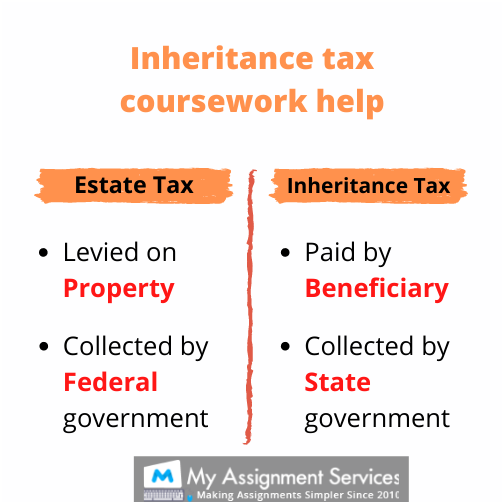

Inheritance tax is a tax levied for the property that you receive from your ancestors in heritage. Most people confuse it with real estate tax but they are poles apart. Writing a coursework on any taxation topic is hard, let alone inheritance tax.

Many students struggle to find the right inheritance coursework writing service. Many companies are robbing students in the name of assignment writing. All they do is get some freelancers to write low-quality content.

Inheritance tax coursework demands students have a stronghold on taxation. It’s other aspects also have to be studied well. It demands from you the coverage of everything that can be a part of inheritance taxation.

When it comes to tax, every element is inter-related. There are taxes dependant on each other. Some are present in a conglomerative manner. Utilizing the right online coursework help can prove to be high-yielding.

Do you know why you are sitting here after decades, writing inheritance coursework? It started with the Romans when it was executed by the laws in Europe. These taxes were and are still considered as indirect taxes. These taxes were initially being collected as stamp taxes. The first-ever inheritance tax was levied in the year, 1797. It closely resembled the British Essay death duty laws. The maximum rate that was imposed on people back then was 10%. However, it kept increasing with time and reached 25%. Before it disappeared, it has reached its ever high of 40%.

This tax is levied on capital wealth and hence, the commonwealth of the nation. It is not charged on income that is earned by the consumer. This tax has played a major role in declining the American fortune; along with divided inheritance. At many times the beneficiary has to pay multiple taxes. With federal taxes overlapping with the inheritance taxes, the customer has to pay double taxes. Considering all the integral details that are present in the tax reforms. The students need to get the entire picture. The endless changes and reforms have led to confusion in the minds of young students.

It makes it hard for them to write their inheritance coursework with clarity and a sense of understanding. It is advised for students to take the required inheritance income tax law assignment while there is still time. The multiple and at times double taxation has lead to the discouragement of collecting huge possessions. The government has earned enough from this source of income to be able to provide employment opportunities.

If the government desires to keep levying high rates of taxes on the fortunes they have to increase the exemptions. This way a healthy balance can be maintained. It’s time for the government to keep their eye on the price, troubling the middle-class working population is not going to yield them big bucks.

Did you know that the inheritance tax comprises more than 7% of the revenue of the states?

You must ensure to stay updated with the latest tax reforms coming your way. The only constant here in the tax world is changes. It is hard for students to stay on their toes all the time. My Assignment Services helps you stay relaxed. Our PhD holding experts take care of your coursework. We have been providing inheritance coursework writing services for decades. Our writers hold expertise in taxation and are always up to date with the latest reforms.

Don’t want to believe what we say? have a look at the sample inheritance tax coursework help from our experts.

It is as easy as placing an order on your favorite online store. Just share your assignment and place an order. As easy as clicking on ‘Place order’.

You can easily track your order and ensure that your assignment is right on track. You can track the progress of your assignment with just one click.

We have an app for you to make it simple for you. You can download the app on both iOS and Android.

After all, it is your assignment. We understand that your assignment should reflect your personality. Until you get satisfied with it, we will not mind revising it.

Inheritance coursework has to be written diligently. We are committed to providing you with nothing but flawless content. We also have some very special discounts for you. Hurry up and enjoy the extra perks.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Check out what our Student community has to say about us.

Request Callback

Doing your Assignment with our resources is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: