Who doesn't want to achieve ‘A’ grades this semester and emerge out with flying colours? Ratio Analysis has given you a brief in mind. But, let us get to know what Ratio Analysis is exactly and how it helps. Ratio Analysis is a quantity-based procedure of getting to know about a company's operational efficiency, liquidity, solvency, and productivity by evaluating its financial reports like the balance sheet and the income statement. Ratio Analysis analyses several parts of financial information in the statements of a business. It is the major part of basic equity analysis. Investors and Analysts make use of ratio analysis.

It's quite difficult to prepare an assignment sometimes, down, but it is possible through My Assignment Services. It engages in a useful and worth knowledgeable journey of Ratio Analysis Assignment Help so that you can achieve ‘A’ grades this semester.

You can always get to know more about Ratio analysis through our skilled and knowledgeable Ratio Analysis Assignment Experts and Activity Analysis Assignment Help, who are ready to help you.

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

As per our Ratio Analysis Assignment Help experts, Ratio Analysis evaluates a company's ability to pay off its short term debts as thefts due by utilising its present or quick assets.

Solvency Ratios are known as financial leverage ratios.

Solvency compares debt stages with its assets, earnings and equity to examine the benefits of the company—for example, debt-equity ratios, interest coverage ratios and debts assets ratios.

These ratios are utilised to analyse finance. It comprises PIE Ratio, dividend, earnings per share(EPS), yield and dividend payout ratio.

These ratios evaluate a company's ability to generate interest payments and other requirements with the debts.

For instance, the debt- service coverage ratio and the time's interest earned ratio.

If you are looking for more such examples and enhance your knowledge about ratio analysis, our Ratio Analysis Assignment Help is a blessing.

Contrast a company's finance dissertation to an equivalent firm in the business and get to know the company's place in the marketplace.

Getting to know about financial ratios like price learning's, from famous competitors and comparing the company's ratios.

Companies can determine the trend in financial performance through comparison. Trend determined can be utilised to calculate the way of future financial presentation, and recognise any estimated financial trouble.

The supervision of a company can also utilise efficiency performance in managing liabilities and assets.

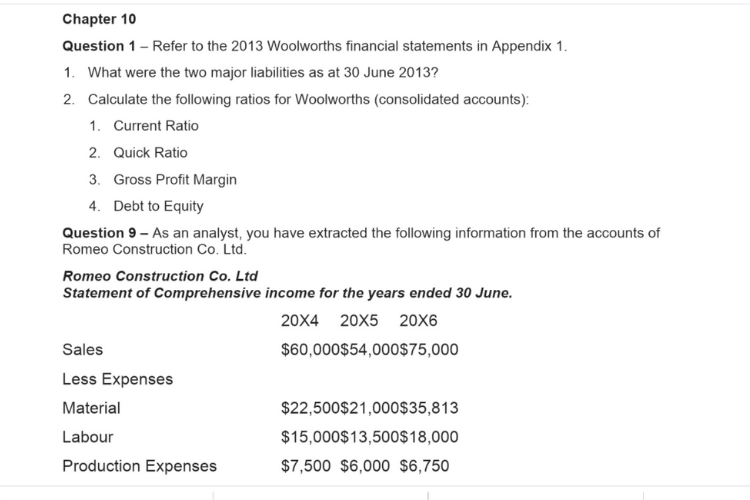

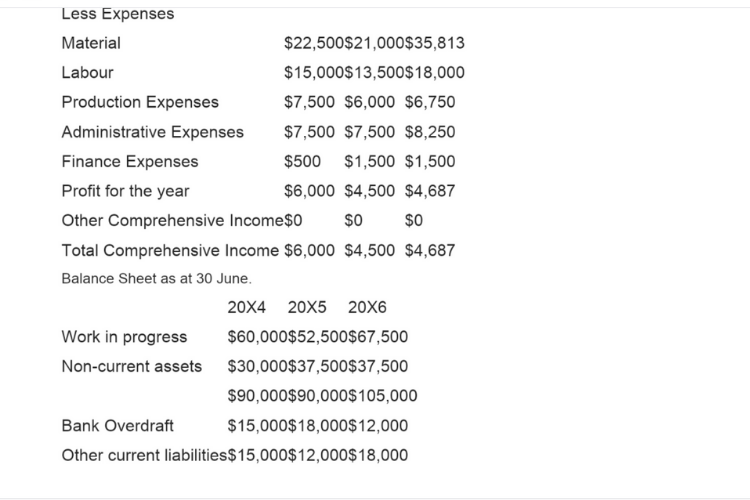

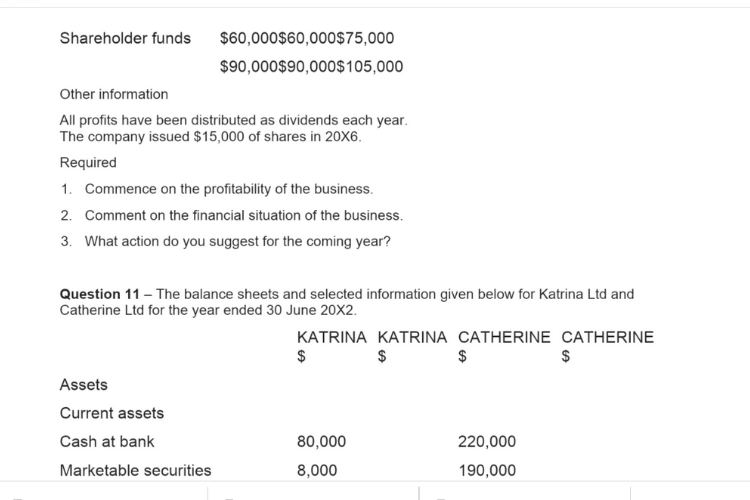

Our Ratio Analysis Assignment Sample would surely guide you more about the uses of ratio analysis and the importance of the same. You can see our samples by browsing our website. Have a look at our recently solved questions:

Explore more about the advantages and usefulness of ratio analysis with the help of our Ratio Analysis Assignment Expert.

Accounts Payableis the payment carried by an association to others for goods or servicesestablished. Purchasing from suppliers on credit will create accountspayable.

Sales cost per Accounts payable (either the last balance or averagebalance).

This ratio deduces how practical the company’s credit and compilation policies are.

This ratio conducts costs / Sales. This margin shows the widespread overheadcost for every dollar earned through sales.

The cumulative reduction of a monetary quantity over time.

Assetsare resources owned and selected by an organisation thatlooks after futurefinancial advantages.

This ratio shows how useful the company is ingenerating sales from its assets.

If you are looking for more glossary, you can take the help of our Ratio Analysis Assignment Writers and get answers.

Current capitalmeans the abundance of current assets compared to current liabilities. The ratio that links current assets to current liabilities is thecurrent ratio. The working ratio implies the proficiency of a company to pay its current liabilities from current assets, and thus specifies the stability of the company’s working role.

Profit is the decisive purpose of every organisation. So if the PQR firm received an income of 5 lakhs last year, how will you presume if that is a good or bad picture? Context is employed to assess profitability, which is given by ratio analysis.

Certain ratios bring out the degree of efficiency of a company in the supervision of its assets and other resources.

If you are eager to know more about the objectives of Ratio Analysis, you can take the help of our Ratio Analysis Assignment Experts and get more insight.

Anenterprise with an operating ratio of less than one is almost always measured incorrectly. A current ratio of less than one means that with every dollar of current debt, the company does not have enough current assets to satisfy the liability. As part of Liquid Assets, supply is included in the current ratio.

RatioAnalysisFormula: The return-on-assets ratio is calculated by dividing net profits by the total of all assets (the number of assets at the beginning and end of the year, divided by two).

Ratio Analysis is a kind of Financial Statement Analysis used to get a rapid sign of a company’s financial presentation in key areas. Ratio analysis evaluates several aspects of a company’s operating and financial performance like its effectiveness, liquidity, profitability, and solvency, etc.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Our sole concept of providing a Ratio Analysis Assignment Sample is not only to assist students to solve/write their dissertations/thesis, essays, case studies, or any other kind of assignment but also to guide students to understand key concepts of Ratio Analysis Assignment topics through top-quality mentorship. We delegate our Ratio Analysis Assignment Help in the UK to help students and scholars based on their subject matter expertise to provide high-quality homework help support. So, make sure to get Top A grades with our online Ratio Analysis Assignment Sample.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Check out what our Student community has to say about us.

Request Callback

Doing your Assignment with our resources is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: