The succession and trust is usually an elective subject for the students of property law. It is also an important subdiscipline of property and equity. In case a person dies without making a legal will, the property is divided as per the laws of intestacy in England. The concept of succession and trust is very broad and it is difficult for a student to know all the concepts of succession. Therefore My Assignment Services have brought to Succession and Trusts Assignment Help.

The rules of succession and trust and intestacy came into existence in the cases of partial intestacy on an individual's demise, leaving a will that shall dispose of some, but not all of their property, and the share per head concept shall apply. In case of partial intestacies, the rules and regulations shall apply only to the segregation of the owner's property that is not recognized by the will. There are many such terms of which you should be familiar with while working on succession and trust assignments. We understand that students have many responsibilities and many other things to complete on daily basis.

Therefore we also provide you with succession and trusts dissertation help in london, succession and trusts thesis help, succession and trusts essay help, and law assignment help.

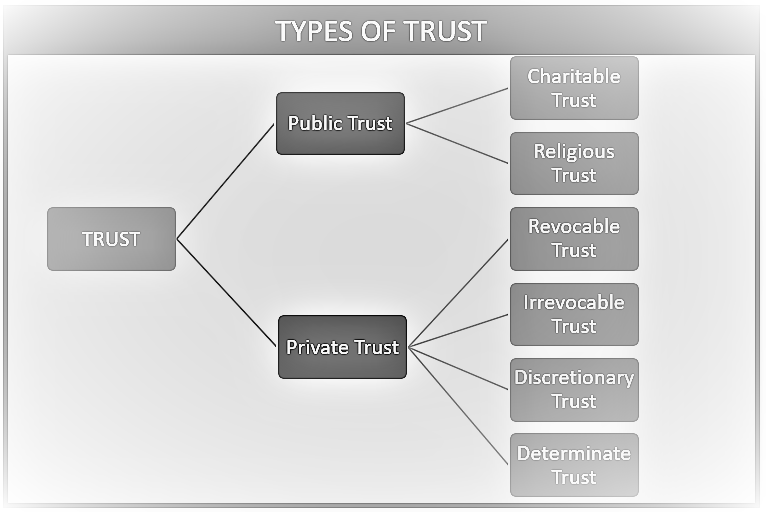

The Law Dissertation of succession and trust is broad enough to cover all the aspects of it here. But still, we will cover some of the important aspects of succession and trust just to make you clear about the subject.

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

One must know that if someone is demised without any surviving spouse or civil partner, but with living children or other descendants, the whole property is given to the children in equal shares. In situations where the son or daughter has passed before the parents, the inheritances’ share will be bifurcated in their dependants.

The Act of trustees which came into effect on October 1, 2014, has made a whole lot of changes towards their intestacy guidelines. Broadly, these regulations ensure that the property distribution is far more favorable and generally accepted to the demised individual's living spouse or partner.

Furthermore, in England and Wales where on an individual’s intestate demise with leaving behind his/her living spouse or partner and children surviving or other dependants, the living spouse or partners inherit and adopt the personal effects or properties of the demised person, the initial amount of property of £250,000 and at least half of the remaining property. This shall mean that in cases where the property does not exceed £250,000, the living spouse or partner is to mandatorily inherit the whole of the property. It is also that the children are supposed to inherit the second half of the remaining property. In cases where a son or daughter has passed away, their share of the inheritance will be divided among their children.

There are many concepts related to it, finding it a bit difficult? No need to worry you may continue with your work and our experts are willing to help you score good grades in Succession and Trusts Assignment at a very nominal rate that every student can afford.

Believe in this, our main objective is to make students life happy by helping them in achieving their academic goals and making his life stress-free.

My assignment services provide you with free samples of succession and trust assignment help just to provide you with a clear understanding of the work done by our experts.

If you find our samples worthy then do avail of our services and let us help you achieve your academic goals.

Various reasons can give you a clear understanding as to why we are the best in the market and the reasons you should seek Succession and Trust Assignment Help from us.

We are proud to have such testimonials on our website. We want you to go through it so that you will have a clear understanding of our work and you will not regret it and can have a clear idea of our customer satisfaction.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

We are glad enough that you are with us till now and you will be happy to know that we serve the top-notch law assignment help you can ever avail of.

Yes, we are glad enough that you are with us till now and you will be happy to know that we serve the best quality solutions you can ever avail of. We have a strict policy for plagiarism and we make sure that your solution is 100% plagiarism-free. We always aim to provide a thorough assurance and this is the reason we provide you with the Plagiarism report. Do you know submitting a Plagiarism report can fetch you some extra scores? Contact us for law assignment help now.

Dont miss an opportunity. It's high time, get your succession and trusts assignment help now and show them you are no less.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Request Callback

Doing your Assignment with our resources is simple, take Expert assistance to ensure HD Grades. Here you Go....

Lock in your expert now.

Pay the rest only after you're 100% satisfied.

Why this is a no-brainer: